how to find bull flag stocks

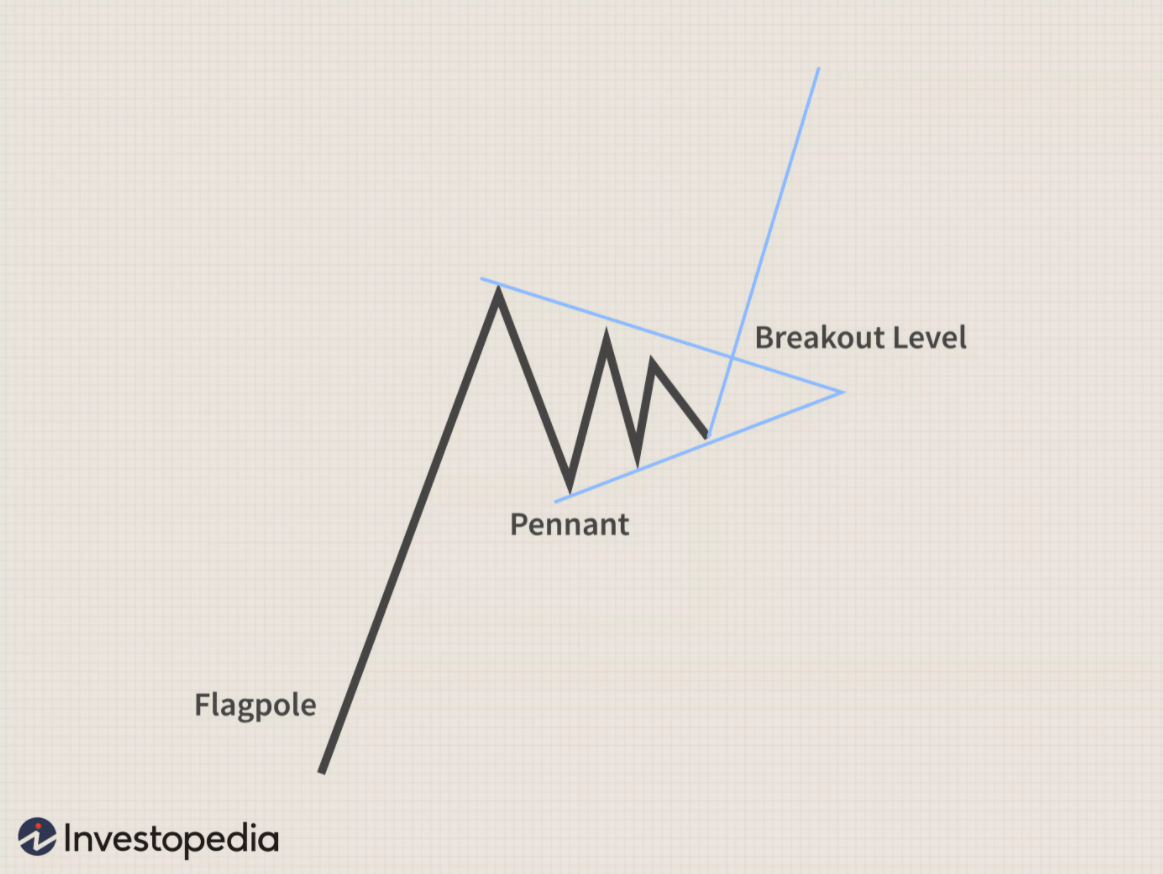

The stock history shows a sharp rise which is the flag pole followed by an up. I think the day.

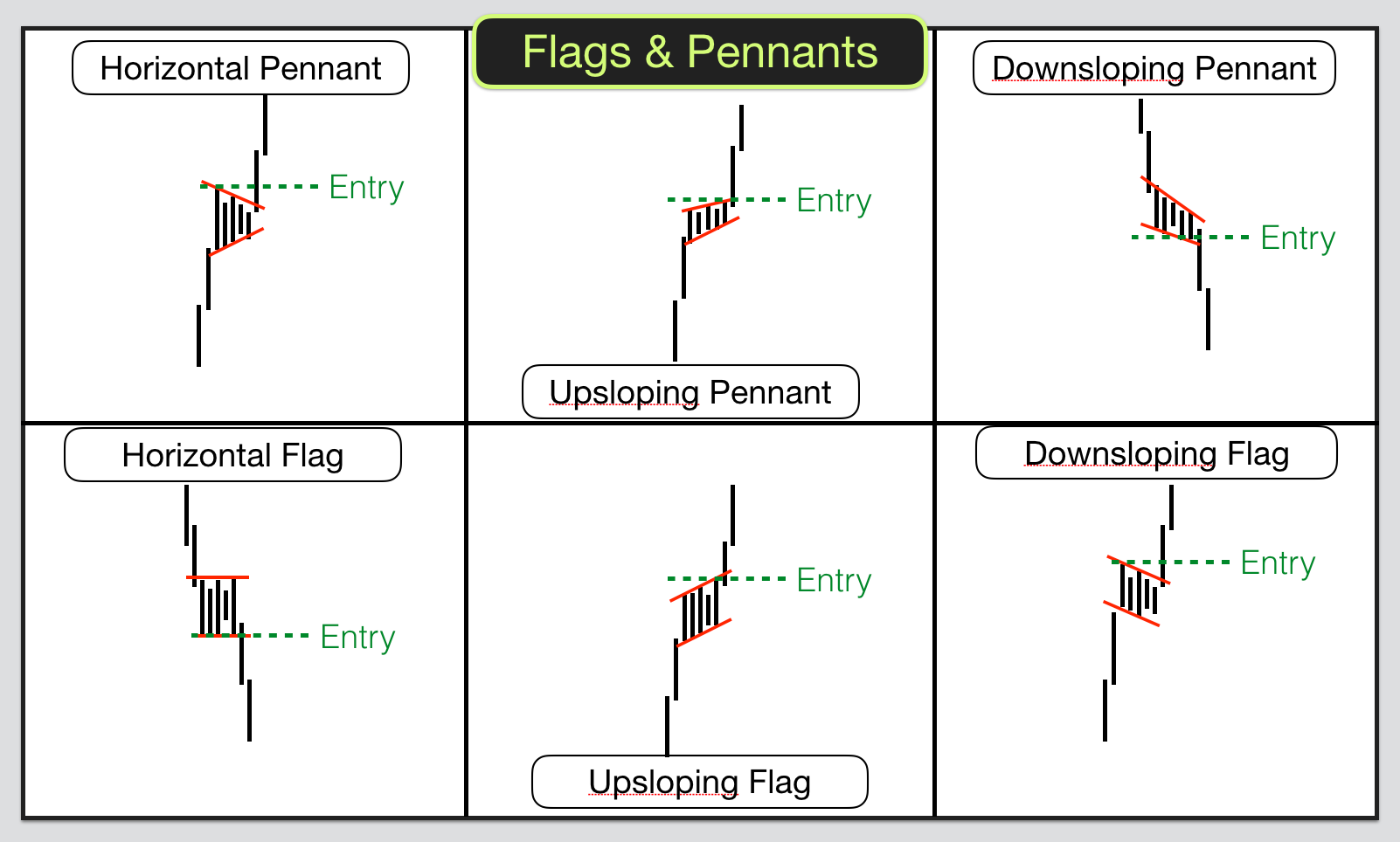

Tutorial On Flags And Pennants

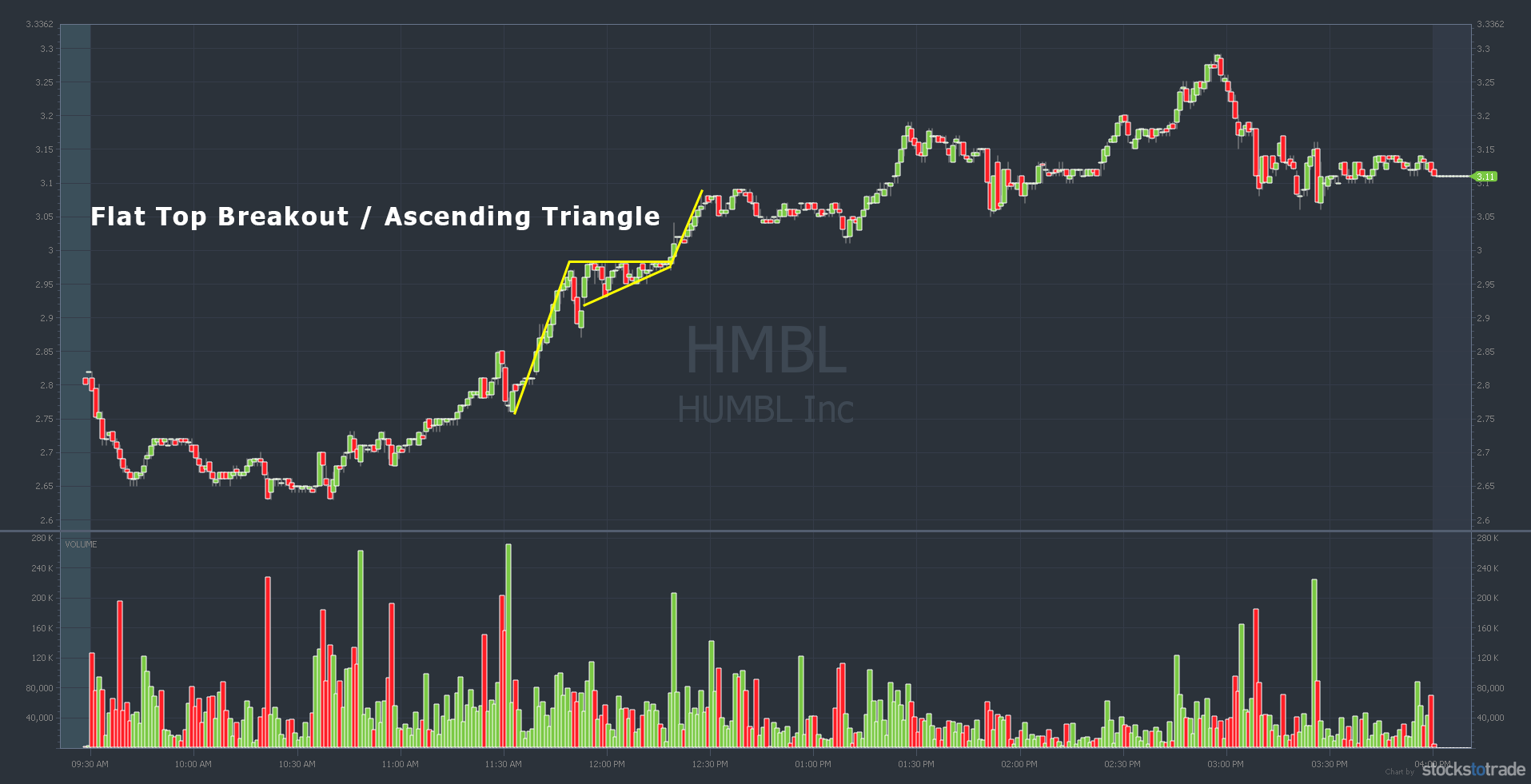

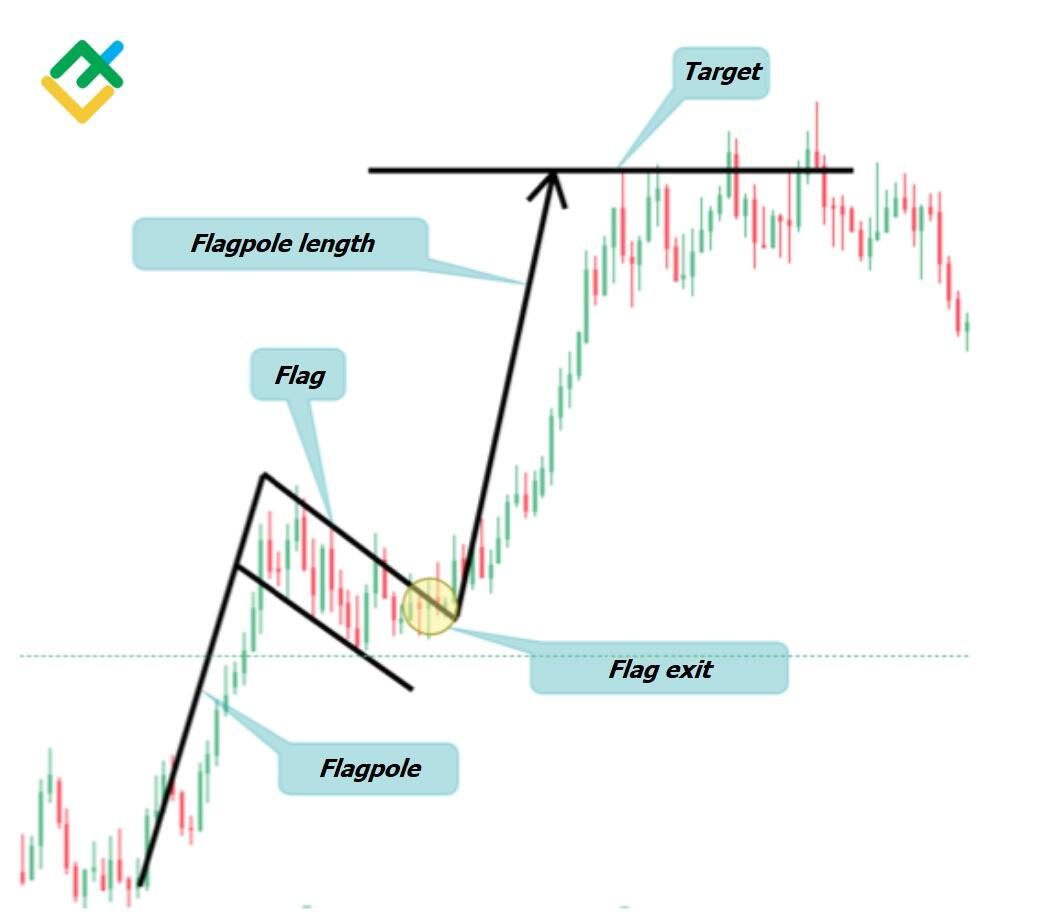

Identify the Pattern The most important part of the flag pattern is to identify a strong trend in either direction as the Flag may be inverted.

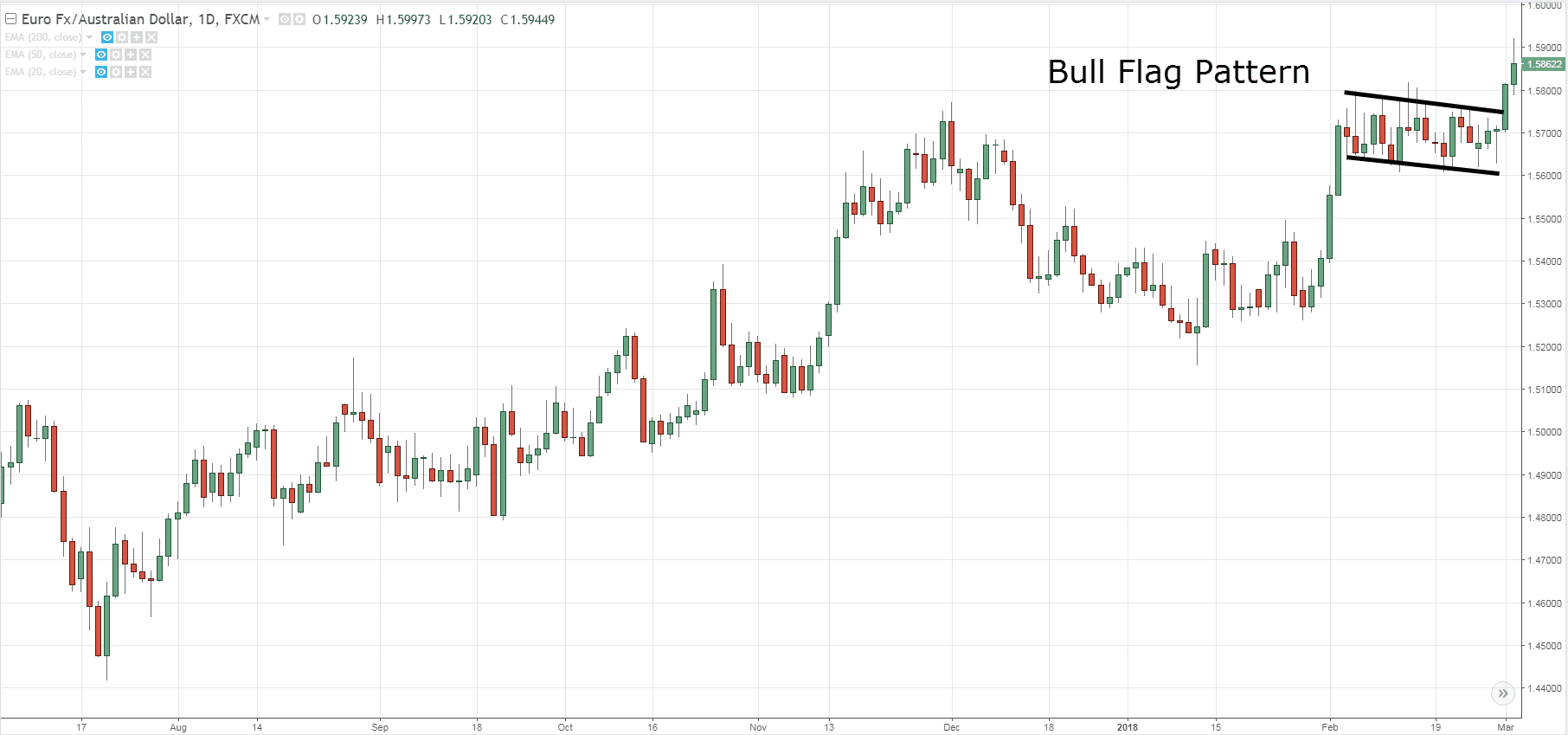

. With a bull flag chart traders see a strong rally in the stock price. The bull flag pattern is suitable for all kinds of assets but is most commonly used as a continuation pattern for stocks and FX pairs. To form the pattern the price rises substantially in a short period of time and then consolidates for.

Thats followed by a period of consolidation where some traders sell and others start to buy. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. The technical setup on this profile is screaming bullish on all major checklist items.

How to Trade a Bull Flag Chart Pattern Step 1. To get fib price level targets first plot the high to low and low back to high price. They are called bull flags because the pattern.

You can use a stock screener such as Finviz to help you find bull flags occurring in stocks. Stay tuned for my 3 st. To find a bull flag chart pattern you first need to identify an uptrend in the stock price.

Bull flags can be found on any time frame you use for trading. Once you have placed an uptrend look for a period of high volume measured in shares. The Bull Flag and Volume Trading volume is an additional key element in identifying a bull flag.

Hey everyone what are your thoughts on this type of video. Finding Bull Flag patterns is quite easy. You simply set the screener in Finviz to show stocks that are overbought RSI 60.

When you couple them with moving averages like the 9 and 20 exponential moving averages you can have a. Using this strategy you can wait for the. How to find stocks that are starting to form a Bull Flag pattern.

If the flagpole price peak is exceeded then you can use Bollinger Bands and or fib price levels. A bull flag pattern is a bullish trend of a stock that resembles a flag on a flag pole. Today we talked about screening stocks and finding good bull flag patterns.

The flag indicates a bullish bias and that the asset. A bull flag pattern is a continuation trading pattern that forms during an uptrend and is typically part of an extended bull run. There is no specific timeframe to spot the bull flag.

Biotech stocks have been exploding in recent weeks as small-cap indexes begin to recover. As the name suggests it looks like a flag pole with a flag on the top portion of the pole. Traders may find it while trading any market including forex stocks indices cryptocurrencies etc.

Bull Flag Pattern Trading Profit In A Bullish Market

Bull Flag Definition Forexpedia By Babypips Com

Are You Taking Advantage Of These 3 Bull Flag Patterns Timothy Sykes

Bull Flag Vs Bear Flag And How To Trade Them Properly

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn

Bull Flag Price Action Trading Guide

Bull Flag Chart Patterns The Complete Guide For Traders

Bullish Bearish Flags And Pennants

How To Trade Bull And Bear Flag Patterns Ig Us

Gold And Silver Look Ready For Bull Flag Breakout Seeking Alpha

Bull Flags And Pennants Definition Chartmill Com

7 Chart Patterns Used By Technical Analysts To Buy Stocks

Bull Flag Pattern A Complete Trading Guide Forexbee

The Bull Flag Pattern Trading Strategy

How To Trade Bull Flag Pattern Six Simple Steps

What Is Bull Flag Pattern And How To Use It In Trading Litefinance

Chartmill Com Stock Screening And Analysis Bull Flags Understand The Bull Flag Technical Pattern And How You Can Find Those Flags Every Day Https Www Chartmill Com Documentation Php A 926 Title Popular 2520screens 25202 3a 2520bull

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw